Fintech is not a term but technology. Uniting the two words, financial and technology, fintech is mainly referred to the advanced functioning of the financial institutions with the integration of technology.

It has been more than a decade now since the launch of blockchain technology, and with the community efforts, the technology has now successfully routed its way into the functioning of many businesses.

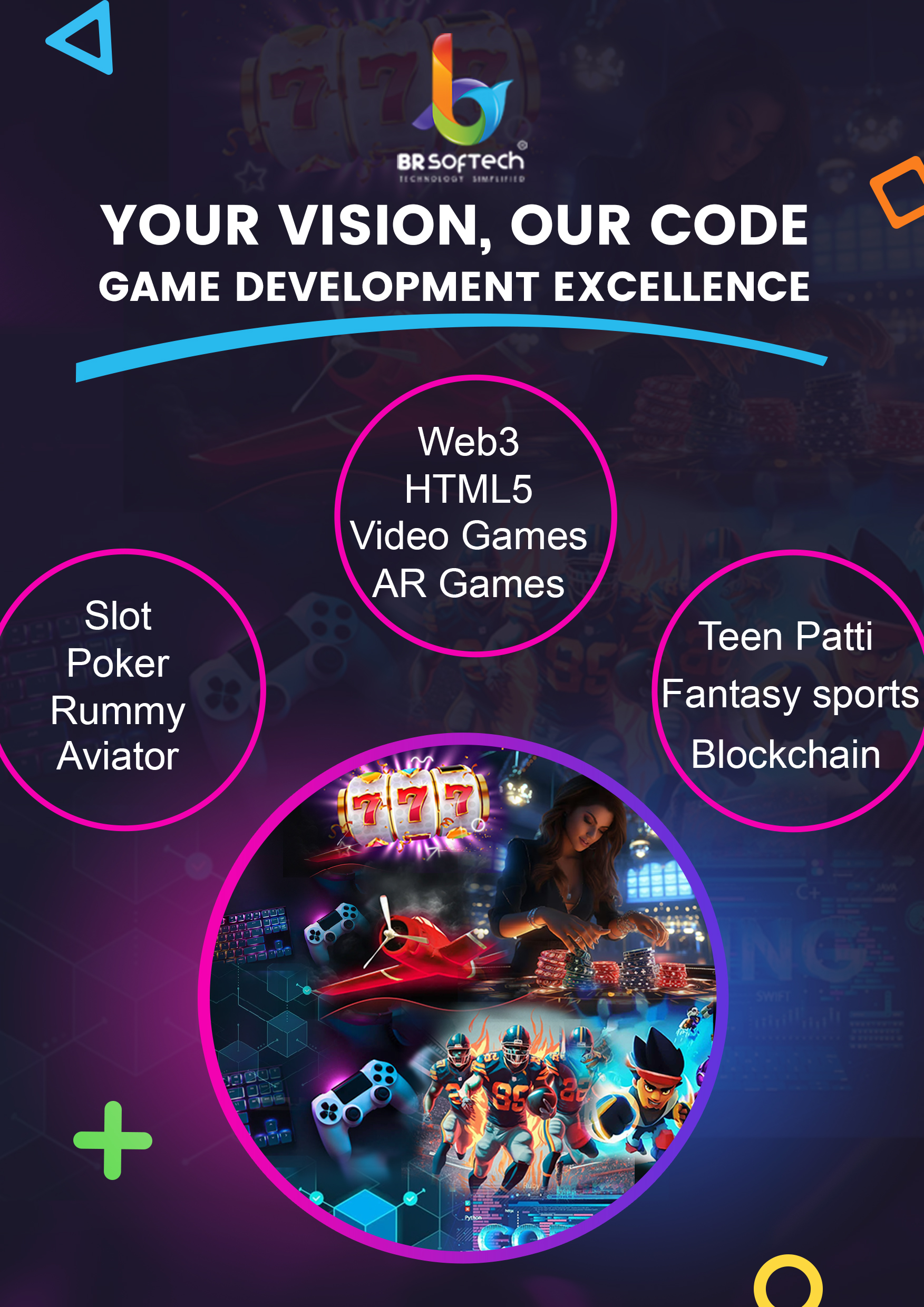

The blockchain development company can help provide a blockchain-oriented platform for your business that will not only help store and streamline the critical information but also help in securely managing the finances.

Read this article to know about how the term fintech came into existence and how the blockchain can aid in revolutionizing the finance handling of your company.

Financial Technology- Fintech

Financial technology covers all the existing and upcoming tech innovations that are related to finances. Fintech has been a hot topic to discuss for its ability to speed up and automate the financial processes. It helps companies, no matter big or small, to better manage their finances by using advanced programs on computers and smartphones.

With its introduction in the 21st century, fintech was initially connected to the back-end processes of the financial institutions. However, over time, the experts have been targeting a more customer-oriented approach to make the finance system smoother for institutions as well as the clients.

Fintech Implementation and Results

Fintech, an innovation, with the potential to disrupt the traditional methods of operations of financial institutions, has become a threat for the organizations having a monopoly in the market.

The technology focuses on enhancing the customer experience by providing a smooth and hassle-free movement while accessing the finance services.

Popular Fintech Innovations

While there can be endless examples of how different organizations are making use of technology, there are some necessary innovations that you need to know for a better understanding of the concept. Let us uncover them one-by-one.

- Cryptocurrency: An advancement over the traditional methods that primarily involves the exchange of paper currencies along with the debit and credit card system, cryptocurrency is not only a buzz word since a decade but also has the potential that adds to its rising popularity.

These digital currencies can be accessed anytime, anywhere with a high-speed internet connection.

- Digital ledger: The blockchain is an endless open-source digital ledger that allows the user to store essential data and information on it. It can be utilized for storing critical pieces of information on this secure platform as blockchain not only ensures transparency but also resists tampering.

- Smart contracts: Blockchain technology has its usage in executing smart contracts. It automates the process of agreements between the buyer and the seller.

- Open banking: Open-banking is a unique concept that promotes the involvement of third parties to gain access to the bank records for developing applications that will help to keep various financial institutions and third-party providers in sync.

- Know Your Customer: KYC is a critical aspect in ensuring smooth and organized operations of financial services. To keep an accurate record of the clients and their activities, the KYC needs to be updated.

The blockchain technology helps store the information on the digital ledger that can be accessed by other institutions for streamlining the process.

Apart from the uses that are mentioned above, the newly emerging digital financial institutions target the technically-sound population and aim towards completely revolutionizing the banking industry shortly.

Impact of COVID-19 on Fintech Blockchain Market

COVID-19 is likely to have a different impact on different sectors. However, the use of fintech in the banking sector has fewer chances of disruption. The global initiative of social distancing has influenced the people to give preference to the digital modes of carrying as many operations as possible.

As a result, fintech is susceptible to grow in the current situation as well as in the future. Fintech has its role in the lending mechanism as well. With the help of fintech, one can ditch the old school method of getting credit and instead depend on blockchain technology to get quick approvals.

Another fact to look upon is the increase of digital trends in the banking sector that has continuously been adopted. The post-COVID-19 world will witness the further expansion of digitization and increased online work.

Final words

Hire a blockchain developer if you seek to expand your business with the help of the technology. Fintech technology has been around from a decade and has a good amount of following amongst the business operators as well as the clients.

Without any doubt, the future of financial management is largely technology-oriented, and this makes investing in blockchain technology a smart choice.